Article of the Day

Battle of the Statehouses – Wall Street Journal

____________________

Iowa has long been the New Jersey of the Midwest with the nation’s highest corporate rate and a punishing 8.98% top income rate. Republicans this year made the Hawkeye State more competitive by putting the top income tax rate on a path to 6.5% by 2023. Over the next three years, the state’s 12% corporate rate is set to decline to 9.8%—assuming GOP Gov. Kim Reynolds isn’t defeated. Her Democratic opponent Fred Hubbell has warned President Trump’s trade brawls may compel him to hit pause on the tax cuts.

~ Wall Street Journal, Battle of the Statehouses, October 24, 2018

Economic Incentives and Growth

Election day nears and debate about tax policy has some prominence in both federal and state elections, at least in Iowa.

2018 in Iowa saw something I wasn’t sure I would experience, passage of tax reform legislation. Since the 1990s I’ve had spirited discussions with a variety of elected officials about a tax structure for my home state that puts it at a disadvantage. A sigh and shrug. “Taxes are hard.” So is life, but most of us get out of bed each morning and make a go of it.

Iowa has consistently ranked between 40th and 50th in various tax rankings. It’s not a fact disconnected from those rankings that the state often ranks in the same place for business startups, venture capital investment, new manufacturing investment, etc.

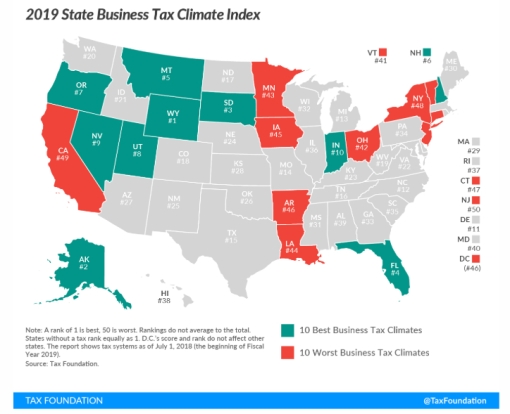

The 2019 State Business Tax Climate Index from the Tax Foundation produced the data in the Wall Street Journal article.

From the report: In 2018, Iowa legislators adopted a comprehensive tax reform package which will ultimately reduce both individual and corporate income tax rates and eliminate the state’s unusual provision of a deduction for federal income tax payments, subject to revenue availability. These changes are not in effect in 2018, but Iowa’s rankings can be expected to improve as reforms phase in over the next few years.

So movement in the right direction at least!

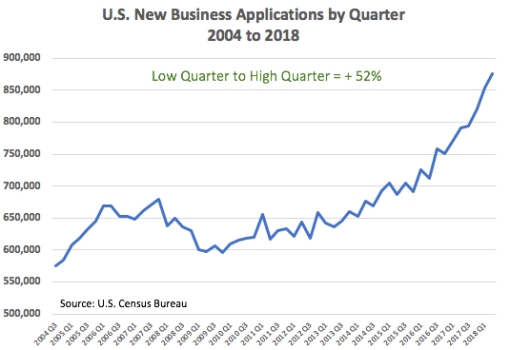

The White House in September was touting U.S. Census Bureau numbers on new business applications. When a new business forms, it applied for an employer identification number from the Internal Revenue Service, so this can be tracked in a fairly real-time fashion.

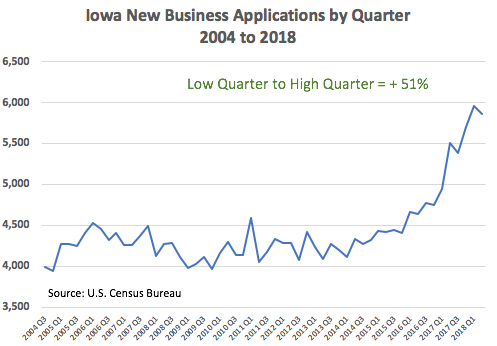

The first quarter of 2018 there were more than 850,000 applications in the United States for EIN’s, the highest number, by FAR, in a long time. Iowa actually tracked this trend with almost 6,000 applications at the same time, though it fell off from the fourth quarter of 2017 whereas the U.S. continued to shoot up.

How many of these corporations actually end up creating jobs is difficult to forecast early, however. Some corporations, for example, may be formed as holding companies or ‘shell’ corporations created for tax purposes. There is nothing wrong with this, but economists are interested in how many end up creating new economic activity, jobs and wealth.

Economists that monitor new business formation have feared for quite a while a long-term drop off in entrepreneurial startup activity. The Kauffman Foundation, for example, has charted this trend and created constructive conversations about its roots and the implications.

Might we be seeing a return to historic levels of new business formation? If so, this is good news indeed for economic growth.

The White House naturally enough touted tax and regulatory reform as the basis for growth. Leaving the political arguments aside, at the heart of this notion is that incentives matter.

Economic growth results when people:

- Produce/work

- Save

- Invest

Disincentives to these three activities will reduce economic growth. Incentives for these activities will increase economic growth. There are caveats, for course, but these represent the core drivers of economic growth.

Federal and Iowa tax policy are now set to provide stronger incentives for production, saving and investing. Improved economic growth, all other things being equal, will be higher.

Of course other things are not always equal. Trade policy, for example, has created significant disincentives in agriculture for production, saving and investment.

But maybe, just maybe, Iowa can leave behind references from the Wall Street Journal and others as the ‘New Jersey of the Midwest.’